How to Choose the Right Loan While Buying in Jupiter

Securing the best loan helps maximize your investment in Jupiter. Here’s how to compare options:

Conventional Loans:

Great for buyers with solid credit and down payments; offers competitive rates.

FHA and VA Loans:

Provide lower down payment options or exclusive benefits for qualified buyers.

Jumbo Loans:

Required for homes costing above federal limits—ideal for luxury properties in Jupiter.

Fixed vs. Adjustable Rates:

Fixed rates offer stability, while adjustable rates may save money initially but can rise over time.

Compare Offers:

Request Good Faith Estimates from multiple lenders for a true side-by-side cost comparison.

Consult your agent and a local mortgage professional familiar with Jupiter’s market for the smartest choice.

Recent Posts

My Favorite Local Businesses in Jupiter and Palm Beach Gardens

Testimonials: Happy Buyers in Jupiter

What Makes My Approach Different as a Palm Beach Gardens Agent

Success Story: Helping a Family Relocate to Palm Beach Gardens

Why I Love Selling Homes in Jupiter

Community Resources for Homeowners in Palm Beach Gardens

Local Celebrity Real Estate News (Recent High-Profile Transactions)

Green Homes and Sustainability—Trends in Jupiter

The Pros & Cons of HOAs in Palm Beach Gardens

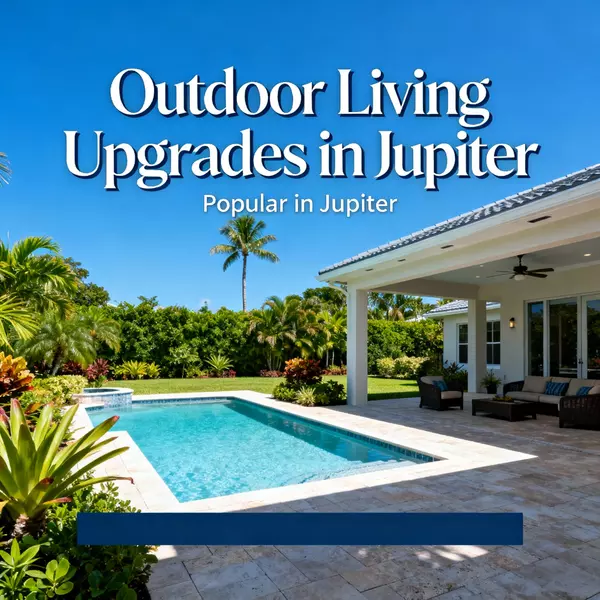

Outdoor Living Upgrades Popular in Jupiter